Powering India's Electric Truck Corridors through Strategic Infrastructure Development

Powering India's Electric Truck Corridors through Strategic Infrastructure Development

With electric trucks gaining momentum in India, the planning and development of charging infrastructure become crucial to the success of electric truck (e-truck) pilot projects. Deploying charging facilities demands financial investment, land allocation, available grid capacity and coordination among stakeholders. Therefore, it is essential to begin strategic planning for the charging infrastructure and necessary grid upgrades at the earliest stage. This article highlights key considerations for effective and proactive e-truck infrastructure planning, with a specific focus on e-truck corridors.

E-truck corridors: Meaning and Importance

E-truck corridors (e-corridors) are highway segments equipped with necessary charging infrastructure to facilitate truck travel along a fixed route. Corridors are well-positioned to become the first movers in the transition to e-trucks in India because of multiple advantages. E-corridors can spur demand and concentrate e-truck deployment, thus increasing the utilisation rates of charging infrastructure along these routes. This guaranteed utilisation enhances the economic viability of the infrastructure and mitigates the risks associated with initial investments. Moreover, these corridors showcase the feasibility of deploying e-trucks and help collect real-world operational data. These insights can generate learnings for accelerated e-truck adoption across India.

A growing number of announcements on e-corridor deployment are gaining attention in India. For instance, on July 19 2023, the World Economic Forum and its partners announced an initiative under NITI Aayog’s e-FAST India programme to deploy 550 e-trucks along key freight corridors in Gujarat and Maharashtra1 In addition, in November 2023, the Office of the Principal Scientific Adviser (PSA) to the Government of India published a report on the deployment of the Delhi-Jaipur zero-emission trucking corridor through various technology pathways2. These announcements on e-corridor development emphasise the importance of analysing charging infrastructure needs and devising a plan for infrastructure development immediately.

Planning charging infrastructure along corridors

E-corridors are expected to see a mix of slow depot charging and fast enroute charging. Slow charging, often implemented by private entities, enables trucks to recharge overnight during downtime, while fast charging, available for public use, offers quick charging along the route without disrupting operational schedules. Seamless corridor development relies on the coordinated effort of charging point operators (CPOs), local governments, fleet operators, financiers and distribution companies (DISCOMs).

Planning the charging infrastructure is in essence a balancing act. On one hand, it is crucial to ensure enough chargers are available to meet peak truck charging demand and prevent queues. On the other hand, constraints such as limited land availability and nearby spare power capacity restrict the number of chargers that can be deployed at a particular location. Moreover, overestimating the need for chargers can result in their underutilisation and diminish the return on investment. To accurately quantify charging infrastructure needs, the following key points should be considered in the planning phase.

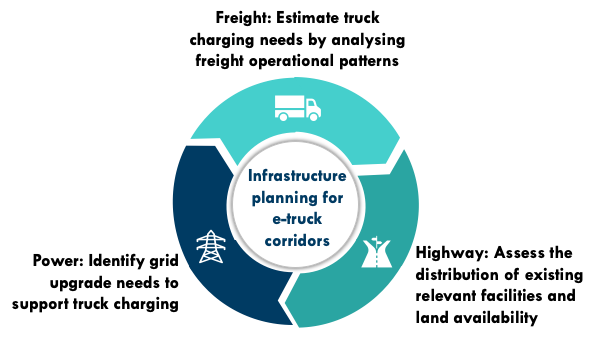

- Freight: Estimate truck charging needs by analysing freight operational patterns. This process begins with understanding the volume of trucks making round trips along the corridor and forecasting projected e-truck penetration rates in the coming years. Subsequently, CPOs can work with fleets to estimate charging demand based on truck operation schedules, covering factors such as departure times, loading and unloading locations. Charger estimation relies on coincident peak charging events when multiple trucks require charging simultaneously.

- Highway: Gather data on the distribution of existing relevant facilities and land availability. The siting of charging hubs relies on various factors, including locations of truck parking lots, rest stations, and existing ICE truck fuel stations. Optimal placement involves selecting sites with high trucking activity, such as near major industrial parks along the corridor, while also considering land availability. While land prices are elevated near highways, it is crucial not to inconvenience truck drivers by making them deviate significantly from their routes to charge. Charging hubs should also be strategically located to alleviate range anxiety, considering the vehicle kilometres travelled (VKT) and battery sizes of corridor trucks.

- Power: Identify grid upgrade needs to support truck charging. Considering the charger size required for truck charging, peak charging events may entail peak loads of up to 50MW or higher. Given that line extension and new substation construction may span several years, initiating communication regarding estimated peak loads and grid upgrade needs with DISCOMs and transmission companies (TRANSCOs) during the initial planning of the corridor project is crucial for timely project execution. Several best practices can be considered to minimise grid upgrade costs. For example, peak loads can be reduced through managed charging programmes that forecast and plan truck charging events around existing evening peak loads to reduce the need for costly transmission-level grid upgrades. Charging stations can be placed near existing substations where spare capacities are available, as substation construction and line extension can significantly delay implementation and increase project costs.

Infrastructure planning for battery swapping

Another technology, battery swapping, also presents a viable option for e-corridor deployment. With battery swapping, depleted truck batteries can be replaced with fully charged ones in 5-10 minutes. Sizing and siting battery swapping stations involve slightly different strategies compared to charging stations. Spare grid capacity is less of a constraint for swapping station siting, as these stations can charge depleted batteries at any time, resulting in lower peak loads. Furthermore, since swapping can be completed faster than charging, stations need not be co-located with truck stops.

For estimating the battery swapping infrastructure needs, the key is to balance ensuring enough spare batteries to meet truck charging demand with achieving project cost efficiency by avoiding investment in unused spare batteries. The number of spare batteries can be estimated by identifying the maximum number of trucks needing to swap out depleted batteries at a given location. In addition, because of the short battery swapping time, battery-swappable trucks can take advantage of smaller batteries resulting in less load penalty. This means that swapping stations need to be placed in greater density along the corridor compared to charging stations to meet truck charging needs.

Case study: Delhi-Jaipur corridor

In November 2023, the Office of the Principal Scientific Adviser to the Government of India released a report detailing the technology feasibility and infrastructure requirements for developing a zero-emission trucking corridor along the Delhi-Jaipur highway. This report discusses the costs, benefits and feasibility of multiple zero-emission trucking technologies, including charging, swapping, and hydrogen-powered trucks.

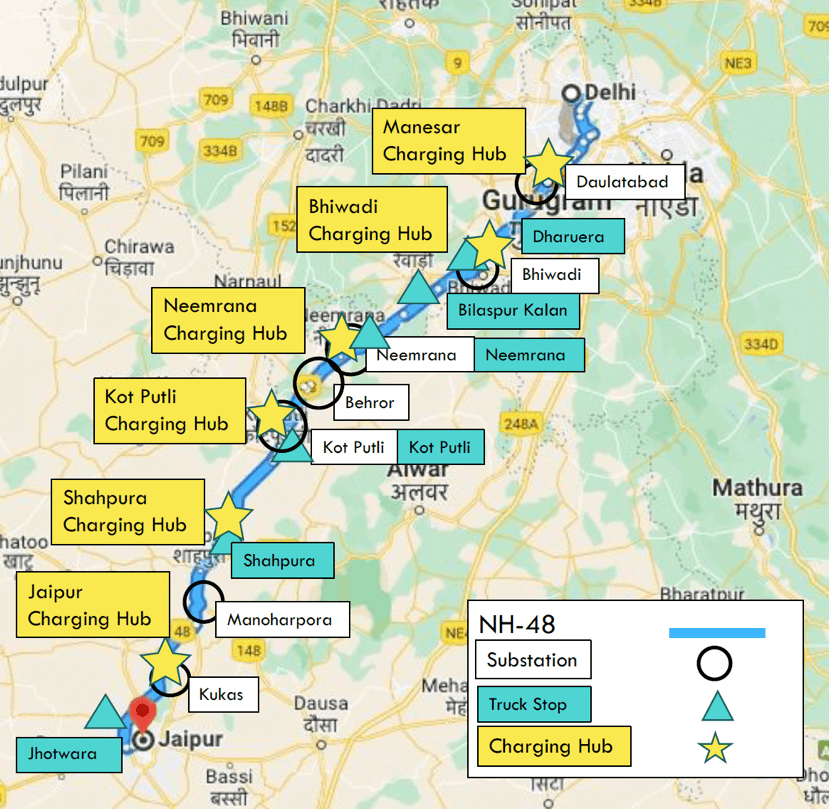

The report quantifies the number of chargers needed if 5,500 corridor trucks are electrified through 2030. If only enroute fast chargers are installed, around 800 chargers will be needed for six charging stations. If the corridor only has 100kW slow chargers, around 3,500 chargers will be required through 2030. The two key data points considered to determine the number of chargers are the hours needed to fully charge a truck and the proportion of trucks that need to charge at a given location based on toll traffic data and existing traffic patterns.

The report also examines the optimal locations for placing the charging stations along the corridor. The map above shows that the Delhi-Jaipur corridor needs six charging hubs by 2030 to support truck charging. These hubs are located approximately 50 km apart to minimise range anxiety. The locations of these charging hubs are based on existing substations with ample spare capacities, truck stops and truck traffic patterns derived from toll data and stakeholder consultations. For example, Bhiwadi needs a charging hub due to its proximity to multiple auto manufacturers in the region, with Bhiwadi and Daulatabad substations ensuring power supply. The Dharuhera and Bilaspur Kalan truck stops in the region indicate that trucks are likely to stop in this area. For real-world implementation of the Delhi-Jaipur corridor project, land availability needs to be considered while selecting the exact location for charging plazas in these identified locations.

Conclusion

Several e-corridor candidates in India have been identified through public and private announcements, based on their high freight volume and significant economic impact. The time is now to initiate conversations among CPOs, fleet operators, DISCOMs, government agencies, and financial organisations to ensure proactive and efficient planning of the corridor projects. The framework discussed in this article can effectively assist these stakeholders in quantifying and conceptualising infrastructure needs to strategically place charging and grid infrastructure and minimise the associated costs.